—-

To stay in the loop with the latest features, news and interviews from the creative community around licensing, sign up to our weekly newsletter here

Start Licensing’s Ian Downes shares some of his licensing highlights from this year’s IFE show.

I attended IFE – a tradeshow focused on the food and drink industry – at ExCeL last month. It attracts around 25,000 visitors, has an international dynamic and focuses on food and drink suppliers, industry trends and developments.

There are a number of international pavilions which showcase manufacturers from a broad range of countries. The show co-exists with another couple of events that focus on the pub trade and also kit for the food industry. It’s a real hub for meeting and networking, which is further underpinned with a well-crafted education programme of seminars and panels.

I have attended the show for a number of years, in part to find new licensing partners, meet existing contacts and also keep an eye on trends. IFE is a great temperature test for trends and a one stop shop to get some insight on new developments.

Licensing-wise it was good to be invited to be part of a panel discussion around brand licensing in the food industry. Kudos to IFE for shining a light on licensing in this way – indeed they did similar in 2022 when I hosted a panel discussion with leading licensee Brand of Brothers. It’s encouraging that licensing is on the radar and that there’s a discussion around its potential for food companies.

The panel was hosted by Karen Green, an author and consultant who has a strong background in retail. Karen has just published a book – Buyer-ology – which looks at the process of selling to retail buyers. The panel was made up of Vhairi Russell from Food Marketing Experts, a consultancy firm focusing on the food industry, and Royce Van Der Zwan from Nando’s. Royce oversees Nando’s licensing activities and was able to use his experience of managing the Nando’s licensing programme to flag up some great learnings and insights.

A key note highlighted was that one of Nando’s watch words when approaching licensing and licensing opportunities is authenticity. This runs through licensee selection, product development and purpose. Nando’s works closely with their suppliers in their core business and expect the same processes to apply to their licensed products.

There was also discussion around the reason for manufacturers to use licensing in the food sector. One noteworthy reason identified was the fact that a licensed range can help a manufacturer gain retail traction and listings. That said, it was also mentioned that when they launch licensed ranges in the FMCG sector, they can be subject to fierce competition from established brands. As a challenger brand, the company behind the licensed product have to prepare an ongoing plan to support their product and not simply rely on the license to get them through.

There was also some discussion around the process of becoming a licensee. Prompted by some questions from the audience, the panel were able to highlight the fact that the ‘cost’ of a license is not necessarily a barrier to entry and that brand owners are open to discussions… Their motivation for entering a category is not always financial, and it’s worth exploring opportunities rather than assuming the door will be closed. Indeed, all the panellists agreed that the current market lends itself to licensing not least as retailers are looking for innovation in categories.

The panel were also asked to highlight brand licensing programmes in the food and other sectors they admired. From my own perspective, I highlighted Marmite – a really good campaign that has integrated licensing into the brand’s ongoing marketing and has seen some very successful launches, ranging from Marmite flavoured nuts through to exclusive lines in Marks & Spencer’s. The Marmite licensing programme has built on the core theme of Love It or Hate It, while successfully celebrating the unique taste and flavour of Marmite.

Royce highlighted Cadbury’s as a food brand that has used licensing well and achieved consistently good results through licensing. Beyond FMCG, Royce highlighted the licensed partnership between SWATCH and OMEGA watches as a collaboration that makes sense, has developed an interesting product and has played to each brand’s strengths.

It was interesting to see how licensing featured in the show and an early conclusion I made was that there is certainly potential for more licensing in the food category. There weren’t that many examples of licensing on show.

“It was good to see IFE providing a showcase for licensing and encouraging to see a variety of licensed products appearing the event.”

One feature of IFE is that there is an abundance of start-up companies and brands exhibiting – a great testament to the effectiveness of the show and its ability to bring in buyers. It did occur to me that some of the start-up companies could benefit from incorporating well-chosen licenses in their offering, not least to give them more firepower at retail and create consumer cut through.

It was interesting to see licensor Smileyworld exhibiting at the show. They have had some success in the food category already, most notably in the frozen food category I believe, but they were attending IFE to connect with more food companies and retailers to build on this start. They had invested in a stand which conveyed their brand well, but they also created product concepts to showcase how their brand could be used in the food sector.

They trademarked the 3D Smiley food shape some thirty years ago and are focused on building their portfolio in the food sector. They have apparently launched over 400 plus Smiley food SKUs since owning the trademark. It’s good to see a brand owner using a focused show like IFE to search for new business and to present their IP in a proactive way, building on their prior success in the category.

It was also interesting to see companies like Pyramid using IFE’s sister show – Hotel, Restaurant & Catering – to showcase their licensed wall art products. From Pyramid’s perspective, the HRC show is a way of tapping into the hospitality market and increasing their reach. Pyramid have recognised that there are new routes to market and fresh outlets for licensed products. It is good to see a licensee being prepared to invest time and money into building new business. Traditional outlets for licensed products are increasingly crowded and competitive – indeed some are under threat of closure – so it is a timely move by Pyramid to investigate new ways of selling their ranges.

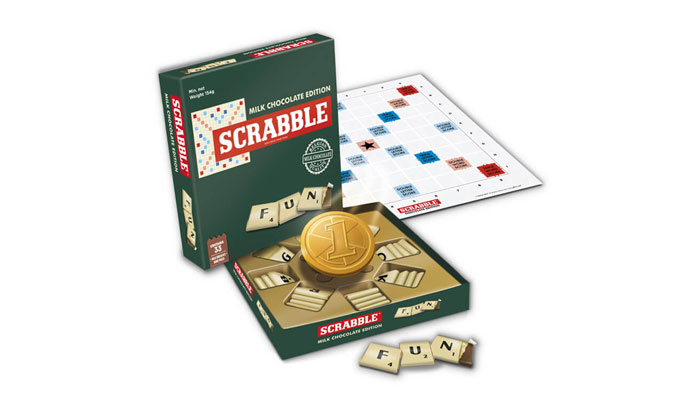

Other appearances for licensing and licensed products included Scrabble and Monopoly featuring on Empire Bespoke Foods’ stand – they distribute these products from Games for Motion. The products are edible board games complete with Belgian milk chocolate and specific gameplay rules. These products have been in the market for some time and are a good example of how licensing can play a part in the food gifting category. Monopoly and Scrabble really give the products a distinct identity.

Empire Bespoke Foods have also developed a range of Weight Watchers products under license. These were featured prominently on their stand. The range is described as ‘Weight Watchers reimagined’ and includes products such as Spiced Mixed Bean & Five Lentil Dal sold in twin pack pouches. A brand like WW brings credibility and authenticity to a category and licensing is a way for WW to enhance their brand, connect with consumers and open up retail channels such as convenience and ‘food on the go’.

A growing trend in food licensing seems to be confectionery brands crossing over into new categories like ice cream and desserts. Retailers such as Iceland are very active in this category and – as Royce Van Der Zwan observed – Cadbury’s have been very active in brand licensing for many years.

A long-term player in the category is desserts company Almondy. They specialise in products like frozen cheesecakes and were at IFE presenting their range, which includes licensed products featuring Oreo, Daim and Toblerone. These are great examples of a brand owner using licensing to stretch the brand experience and to see their brand involved in as many relevant eating occasions as possible.

Products like frozen cheesecakes give brands like Oreo an opportunity to appear in store beyond their core area and also to reinforce their brand values. For Almondy, they are able to utilise brands with global reach, distinct flavour profiles and a premium feel. It also insulates them against competition in their category.

Given IFE is an international show, it was perhaps no surprise to see character licensing popping up on a number of companies stands – most commonly in the confectionery category with suppliers from countries such as Turkey showcasing licensed ranges. It was also good to see that most of them had signage to explain which markets they had the licensing rights for. This is a small example of a growing maturity in licensing in regards to distribution and territorial rights, but also confirmation that licensing is increasingly an international business.

To further emphasise this, there was a Japanese company at the show presenting confectionery, chocolate and packaged goods products that featured brands such as Felix and Kit Kat – they were seeking international partners I believe. There is definitely a growing interest in retailers in markets like the UK selling product from markets such as Japan, Korea and the USA… Consumers seem to like the styling, presentation and taste of products like these. Noting the earlier point about rights and territories, if this trend scales up it might create some challenges contractually.

Elsewhere, TTK Confectionery were at the show – they are a company who are using licensing to grow their reach and distribution having developed a range of shaped chocolate figurines using The Original Stormtrooper brand. This is a product range that has been developed with great attention to detail and fits into the trend for 3D chocolate figures.

Retailers like M&S have been developing this category over recent years with licensed and non-licensed ranges, and products like these are focused on gifting and occasions. Products like these resonate well with the fan community, and the category definitely has more potential for licensing. That said, it does require the sort of considered NPD approach that TTK have taken with this range.

A final couple of licensed ranges I spotted at IFE were a range of water in tins from a company called Pure Norway Water. They have developed a Smurfs range with the cans featuring a number of different character designs – the motivation for this range seems to be encouraging children to drink more water. Using a character brand that is internationally recognised gives Pure Norway Water the opportunity to build distribution and to compete in a very competitive category.

Proving that there is always something new to see even for a ‘licensing veteran’ like myself, I spotted a range of Hello Kitty wines from Italy. The range consists of sparkling Rose, Pinot Noir red wine and Pinot Nero White Wine. They are presented with labelling featuring Hello Kitty in a very distinctive styling.

Interestingly, the distributors were keen to point to the quality of the wine including review notes alongside the products. In this context, I guess they are targeting the gifting market and also creating a conversation piece. The product would certainly stand out on shelf and attract attention in a busy sector, but the wine has to be good quality to ensure repeat purchase and consumer satisfaction.

Given the age of Hello Kitty and its classic status, it is understandable that the brand owners are interested in developing products that reach – and appeal – to older consumers. This sort of development might at first glance raise eyebrows, but it’s a reminder that licensed brands can evolve other time and licensing plans have to be adjusted accordingly.

It was good to see IFE providing a showcase for licensing and encouraging to see a variety of licensed products appearing the event. There is certainly a fit between food and licensing. From a licensing industry perspective, it’s good to see companies like Smileyworld and Pyramid finding new ways to engage with potential partners.

Going back to the panel I took part in, it would seem that the way forward in this sector is to be authentic in your approach to licensing and also for brand owners especially to be prepared to be open to discussion with food companies. There are opportunities out there.

Enter your details to receive Brands Untapped updates & news.