—-

To stay in the loop with the latest features, news and interviews from the creative community around licensing, sign up to our weekly newsletter here

Start Licensing’s Ian Downes looks at how restaurant brands like Wagamama, Harry Ramsden’s and Yo! Sushi are embracing the retail space with licensed ready meals, sauces and cooking kits.

It has been interesting to see how the restaurant sector has recently become more engaged in the brand licensing and brand extension space. Looking at activity in retailers such as Iceland, Tesco and Waitrose, restaurant brands are popping up more and more on shelf – and in chiller cabinets.

There are a number of examples of ‘restaurant brand activation’ in retail at the moment. One brand that has been a pioneer of this kind of activity is Pizza Express. Their brand has been in retail for a number of years with chilled pizzas, dough balls, sauces and dressings making up part of their retail range. Recently a Vegan pizza has been added to their offering reflecting changes in consumer habits. In addition, new launches have included three pasta ready meals, flatbreads, salads and desserts.

The Pizza Express range features across a range of retailers. Interestingly the retail products have often included an offer linked to dining in at Pizza Express restaurants. This is a clue to part of the motivation for restaurant brands to go down this route. It provides them with a platform to promote themselves and build an ongoing relationship with consumers.

Nando’s is another example of a restaurant brand that is firmly established in the retail space, with products such as sauces and marinades. Pizza Express and Nando’s are probably two brands that other casual dining restaurant brands have looked at from a licensing point of view and been encouraged to think about how they can deliver their brand into retail.

Iceland is a retailer that has successfully used brand licensing to build up a formidable portfolio spanning brands like Greggs and Slimming World, which they have developed in the frozen category on an exclusive basis. They have also recognised the potential in restaurant brands and have struck up partnerships with Harry Ramsden’s and TGI Fridays.

It is not always easy to work out the exact terms of these partnerships from the outside, but it’s likely that there is some element of exclusivity in Iceland’s use of these brands. They are a canny retailer and have recognised that brands can help them compete with other retailers and create a point of distinction for Iceland in a competitive sector.

Brand licensing can help a retailer like Iceland move beyond competing on price. Brands like Harry Ramsden’s and TGI Friday are well known and understood by consumers. They can be used to deliver specific product offerings in core categories. For example, the Harry Ramsden’s range includes cod fillets, wholetail scampi and battered sausages – all classic products that will appear on lots of shopping lists. Elsewhere, the TGI Friday range ticks a box in terms of treat purchases and special occasions.

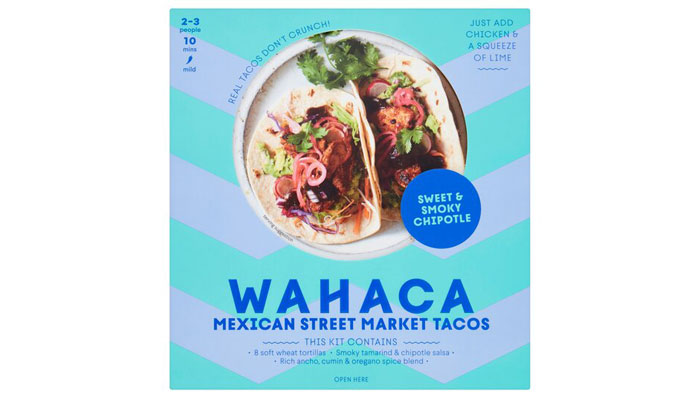

This trend is not confined to long-standing restaurant brands. ‘Younger’ brands such as Leon, Yo! Sushi, Wahaca, Wagamama and Itsu have also entered the market. Broadly speaking these brands are associated with specific cuisines and culinary styles.

From a retailer’s perspective, working with these kind of brands helps them segment their offer in categories like chilled food-to-go. The retailer knows that these restaurants have worked hard to build their brands in a defined way within specific market segments – and in turn consumers have a ready-made association with these brands. In short, the restaurant brands make consumer choice easier and instil confidence for consumers.

The retailers are tapping into ready to go brands. There shouldn’t be a time-lag with NPD from these brands as they are effectively delivering products that are proven good sellers, albeit within a restaurant setting.

It isn’t just supermarkets taking advantage of restaurant brands as WHSmith are offering Yo! Sushi product as part of the food-to-go range. From a practical point of view, a time-poor customer will gravitate to a brand they recognise and in this context, established brands work well.

The push by restaurant brands to feature their brands at retail may have been accelerated by lockdown. With many restaurants closed and operating conditions very different, the opportunity to bring their brands alive at retail has become more attractive. Clearly it creates retail presence and is a fantastic flag waving exercise for them. Of course, it’s a source of revenue as well.

There is a further upside in how the brand is viewed by investors and potential purchasers. A restaurant brand that can operate beyond its fixed premises will be valued more highly. Licensing and retail developments are a clear demonstration of a brand’s commercial appeal and in some cases, this kind of activity can help project a brand onto the national stage. This is particularly appealing to those brands that are city centre focused or heavily skewed to one geographic location.

Consumers have seemingly responded well to the opportunity to have a at home ‘restaurant dining’ experience during lockdown. It has provided a feelgood factor and created a point of difference to consumers whose lifestyles have been restricted. A night in can now be a night out.

Brands like Wahaca and Wagamama are probably trying to strike a balance in terms of which retail channels they appear in and maintaining their core market appeal. It would be easy to undermine the core appeal of a restaurant brand by taking wrong turns in product development terms or retail placement.

Wagamama’s new products which include pastes, sauces and meal kits have been launched initially in Waitrose, with a further retail roll out to come. By going into retail, restaurant brands are exposing themselves to fresh challenges – not least competing with established FMCG brands and of course conceding some control over their brand.

When a brand owner decides to enter the licensing market, they have to make some adjustments to their business model. A major one is that most often they have to place their brand trust in the hands of licensee. There are a number of licensees who have developed this sector well. One notable example is All About Food who manages licensing deals on behalf of restaurant brands such as Nando’s, Wagamama and Pret A Manger.

Beyond food-on-the-go, ready meals and ingredients, restaurant brands are also very active in the publishing category. These brands are also increasingly seen as part of the composite gifting offer at Christmas in retailers like Boots and Sainsburys and it’s likely we’ll see more taking the licensing path in the future.

It will be interesting to see if this will include restaurant brands developing partnership activities in emerging spaces like experiential licensing… Could we see Yo! Sushi cooking classes for example?

Maybe licensing will allow restaurant brands to explore food products beyond their core areas but in logical ways. For example, could Harry Ramsden’s get involved in the bakery category – consumers often have bread and butter with fish and chips!

It’s a very interesting category of licensing and one with huge potential for growth.

Enter your details to receive Brands Untapped updates & news.