—-

To stay in the loop with the latest features, news and interviews from the creative community around licensing, sign up to our weekly newsletter here

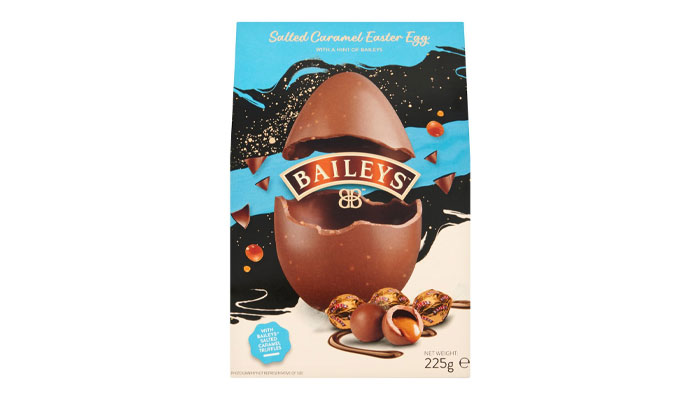

From Cathedral City Heinz Beanz to Baileys easter eggs, Start Licensing’s Ian Downes puts food brands in the spotlight.

The FMCG category seems to be one that is embracing licensing more and more.

In recent weeks there have been a plethora of new launches featuring well-known brands. All indicators are that licensing deals, partnerships and collaborations are firmly on the radar of FMCG brand managers and are now given consideration to become part of their programmes.

There is probably no one reason to explain this increase in activity, although it’s reasonable to assert that activity begets activity. 2023 saw a number of successful licensing partnerships brought to market and I’m sure these have given brand teams more confidence in the value and potential of licensing partnerships.

There is also likely an economic consideration at play – partnerships can help bring brand owners additional marketing muscle without necessarily costing them more. There is the benefit of one plus one can make three – partners can work together to deliver a bigger in market impact by pooling their resources. Beyond the brands themselves, consumers seem more willing to try new products and flavours – particularly if they recognise the brands delivering these taste experiences.

Retailers are facing challenging times. Licensing lead NPD can be an attractive product option for them to list, not least as these collaborations bring momentum with them. Importantly, the brands involved aren’t entirely unproven so these are new products that can be trusted. Often they are also a quicker win in terms of NPD as well. Retailers are getting new products without necessarily having to on board new suppliers or test unknown brands.

Here is a list of 10 recent highlights in the FMCG licensing and collaboration sector… Collectively and individually they illustrate how the FMCG market is embracing the opportunity with creativity and innovation. One caveat is that from the outside, it’s difficult to fully understand the nature and structure of the partnerships. What these examples are showing is that brands are embracing the spirit of partnership at the moment and are developing some very engaging products through collaboration…

Muller Yogurt & Desserts have launched two Cadbury Creamy Chocolate shakes. The two products are a standard chocolate one and a chocolate caramel one. Initially launched in Sainsbury’s, they are scheduled to sell for a regular price of £2 but were launched at £1. This is a great example of how a well-established brand like Cadbury’s provides a manufacturer with the opportunity to create products that deliver a flavour profile consumers are familiar with, like and trust. It extends the Cadbury brand beyond its core and Cadbury has the reassurance of working with a category leader and expert. It’s also a partnership that can operate at a noteworthy scale, engaging national retailers. Brands like Cadbury are mindful of return on investment and want to licensing to deliver at a level that makes sense for the scale of their business.

In a similar vein Heinz announced a partnership with Cathedral City cheese. The two brands have joined forces to develop a Cheesy Beanz product that combines Heinz beans with Cathedral City Extra Mature Cheddar; the cheese has been cooked into the bean sauce. The cheese and beans combination is a common one in catering situations and at home, so part of the thinking behind this must be to capitalise on a product combination that is already taste-tested and appeals to consumers. It’s scheduled to launch in Tesco initially after an online launch via the Heinz to Home platform. The stock allocated to the Heinz to Home platform sold through quick quickly – a good indicator to the appeal of the product. Another driver for activity like this is arguably to create consumer engagement, specifically with an eye on social media and driving the brand narrative there. Retailers are also looking for exclusives and the opportunity to launch ‘new’ things. Combining two powerhouse brands must seem like a safe and attractive bet for Tesco.

Exclusivity seems to be a big part of the appeal of these kind of partnerships. New and interesting products that feature trusted brands fit into this engagement strategy. Lidl recently launched Nutella flavoured muffins – the muffins were sold in Nutella branded Muffin cases, reinforcing the ‘official’ status of the partnership and reassuring consumers that the muffins were made using ‘real’ Nutella. Bakery is a category where licensing has a strong track record, not least as baked goods work well with added ingredients and flavours. Companies like Krispy Kreme have shown how brand collaborations can flourish in the category.

Activations can work on different levels in different ways, with a product being the hub at the centre of a wheel of marketing activities. Recently Oreo partnered with classic arcade game Pac-Man to launch a special edition Oreo pack of Pac-Man Oreos. The Oreos were designed to feature the iconic Pac-Man characters on them, while the signature Oreo pack design was adjusted to include Pac-Man. This featured a nice design touch that saw an Oreo Pac-Man about to consume the Oreo logo. The partnership was heavily promoted in the grocery trade press, including full page advertisements in The Grocer. This gives some clue to one of the purposes of these kind of partnerships for a brand like Oreo. It’s a statement piece and a way of showing the grocery trade that Oreo is a progressive brand coming to market with fresh thinking.

The activation was also linked to gaming experiences and a competition that had a prize fund centred on unique Pac-Man x Oreo merchandise, coupled with the chance to win a holiday in Japan to visit Bandai Namco’s newly opened gaming centre. Perrine Pierrard-Willaey, Marketing Director Europe at Oreo, gave some further insight into the partnership, saying: “We’re always looking for new ways to add a twist to the way we snack and play. We hope this activity helps cookie and gaming fans to chase playfulness as they take part in this nostalgic gaming experience.” This talks to the ability of partnerships like this to engage and inspire consumers, while underpinning a brand’s core values. In a busy marketplace, partnerships like this one can cut through.

Another recent partnership that caught the eye – and demonstrates how well-known character brands can find traction in the sector – was the launch of a Tiger bloomer loaf by Jackson’s of Yorkshire. The loaf which is on sale in Morrison’s features artwork from Judith Kerr’s The Tiger Who Came to Tea. The partnership is centred on adding a character identity to a pre-existing style of loaf. The character-led packaging will stand out on shelf in what is a busy fixture. It’s also a category where it can be challenging to achieve product differentiation.

A partnership like this one shines a light on the product and its attributes. In partnering with a publishing brand that’s well established with parents and younger children, Jackson’s have created an opportunity to reach a new audience. The product is a source of Vitamin D and calcium, and is also palm oil free and packaged in 100% recyclable packaging; all elements which will enhance its appeal to parents. From a retail point of view, beyond the initial launch in Morrisons, I am sure it has driven conversations with other retailers, not least as it shows Jackson’s are taking an innovative approach to a category which can be quite traditional in NPD terms.

Marmite is a brand that has a long tradition of using licensing as a way of extending the brand experience. The Marmite taste and flavour is distinctive and licensing partnerships include crackers, peanut butter and cashew nuts. Product developments like these create new ways for the brand to be tried and tasted. The latest addition to the Marmite licensing family is the launch of Marmite Crisps in partnership with Tayto Crisps. Following an initial launch of crisps, Tayto will also launch Cheese & Marmite Puffs and Tortillas. These new additions to the Marmite product family have the potential to reach different consumers and, perhaps in some cases, younger consumers. It also extends the occasions at which people can consume Marmite.

Walkers Crisps previously had a Marmite flavour in their range but discontinued this at the end of 2023. Marmite brand owner Unilever responded quickly to find a new partner and indeed, looking at social media, have responded to consumer demand to do so. This is a good example of how a licensing partnership can dovetail with wider activities like a social media campaign, while also helping to build the connection with core consumers. That said, Tayto’s plans to broaden the range into categories like tortilla chips should also see this as a partnership that should deliver new Marmite consumers to Unilever.

FMCG brand licensing can flow the other way as well, with FMCG brands using licensing as a way of launching their IP into new categories outside of classic FMCG channels. For example, confectionery brand Millions is working with Novatissue who have launched a range of scented kitchen towels and toilet rolls. Scents used include Bubblegum and Apple, mimicking core Millions flavours. For Millions, a partnership like this is arguably attractive as it extends their in-market brand presence, securing new and additional shelf space. It also underpins their flavour credentials. Another upside of licensing that shouldn’t be underestimated is that it generates a revenue stream. The income derived from licensing is a welcome addition to the bottom line and is often re-invested into core brand marketing.

Celebrity brands are also very active in this sector. Alcohol in particular seems to be a product of choice for many celebrities seeking to build their brand portfolio. Kylie Minogue and Graham Norton have both enjoyed success in the wine category for example. A recent addition to this market in the UK is Tesco stocking Kendall Jenner’s 818 Tequila. It was reported earlier this month that the tequila, which was first launched in 2021, will be on sale in 643 Tesco stores nationwide. A celebrity-driven product like this will grab consumer attention and will undoubtedly benefit from the PR that Kendall Jenner generates. As noted with some of the other highlighted products, it will stand out in a competitive sector and bring a lot of marketing value with it. Celebrity and FMCG go hand in hand – there are a number of examples of well-established products in the market focussed on celebrity brands including ranges featuring the likes of Ainsley Harriott, Jamie Oliver and Loyd Grossman. These sorts of ranges can become well established and over time seen as standalone brands in a category.

The Schwartz brand recently launched a line of spices, blends and recipe kits with Nadiya Hussain. The range is listed in retailers like Tesco and Asda. They have followed this up with another licensed range, this time a range of recipe kits developed in association with three of the UK’s best known restaurant chains: Bella Italia, Las Iguanas and The Real Greek. This range allows Schwartz to explore new spice mixes with the support of brands that are popular but also come with a focus on specific cuisines. It’s also arguably tapping into the trend for dining at home that was boosted during the Lockdown period.

The launch of this range reflects the fact that consumers are looking for fresh inspiration around meal planning and budgeting. This partnership has also created a promotional platform for the restaurant chains as it includes offers to dine in the restaurants. At first it may seem odd for a restaurant chain to develop at home recipe kits, but it’s a way of building their brand ‘at home’ in way that underpins their flavour credentials. Restaurant brands such as Pizza Express and Nando’s have a long history of success in brand licensing, blending the at home with the in-restaurant dining experience successfully.

Lir Chocolates are a long-standing licensee of the Baileys brand. They use Baileys as a flavour within products like truffles, chocolate bars and Easter Eggs. They have recently added two new Easter Eggs to their portfolio… One is a Salted Caramel Egg with a milk chocolate shell, crunchy caramel pieces and includes some Baileys flavoured truffles. The other is a white chocolate egg with strawberry pieces and also includes truffles. In this context Baileys adds a distinctive taste and flavour, coupled with a premium identity for the products. In seasonal categories like Easter, smaller manufacturers are being increasingly muscled out by their bigger competitors. Working with a strong and unique brand like Baileys allows Lir to compete with global brands in the category and to deliver a unique brand to the market.

Alcohol brands seem to like using licensing in categories like chocolate, sauces and bakery to extend their brands whilst reinforcing the unique flavour attributes of their brands. Brands like Guinness and Jack Daniel’s have well established food licensing programmes. Elsewhere, beer brands like Budweiser are active in the sector, specifically around opportunities like snacking where products – like nuts – dovetail with the core Budweiser brand, extending the brand experience. Licensing like this can also help brands breakthrough into more social situations and occasions.

As this snapshot shows, it’s a busy and active period for licensing-led partnerships in the FMCG sector. It is likely that we will see more examples emerging across the rest of the year. It will be interesting to see how some of the featured partnerships perform and whether they inspire other brands to take a similar path. I am sure there are lots of brand managers and product developers thinking through their options at the moment and thinking about this equation: one plus one can equal three in FMCG.

Enter your details to receive Brands Untapped updates & news.